With the US Treasury yield curve inverting for the first time since 2007, we have our first reliable signal from the market that a recession is around the corner, perhaps by 2021 or earlier.

From a simple retail investing standpoint, an impending recession means that we want to stash away cash, and perhaps load some of it into our brokerage accounts when the fire sale swings by. Load and ready.

My current means of stashing cash - DBS Multiplier and Singapore Savings Bonds

The DBS Multiplier account is of course one of my workhorse accounts for monthly working capital. The Singapore Savings Bonds (SSB) have been a crucial part of my funds management, and form part of my monthly savings and source of passive income (with a SSB bond ladder).

I view SSBs as an intermediate form of liquidity with moderate yields, with cash in my DBS Multiplier account being more liquid and my dollar cost averaging (DCA) investments being less liquid (may inevitably realize losses if cash is required). On the other hand, SSBs have pro-rated interest payout and a one-month redemption latency with no penalty - functioning well as intermediate liquidity.

(In addition, MAS recently (February 2019) announced that SSBs can be purchased using SRS funds, via the respective SRS operators. This meant that the new risk-free rate in our SRS accounts becomes the SSB yields, making the use of SRS for tax breaks that much more attractive.)

A reasonable point of view on future SSB interest rates trends

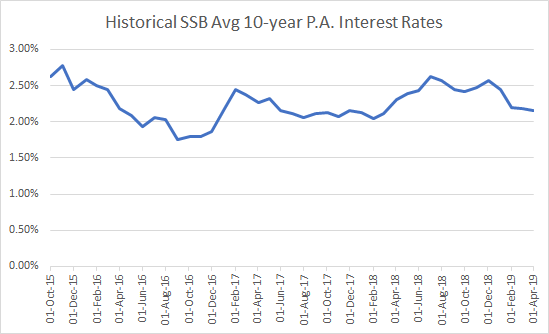

This month’s (purchase March 2019 for April 2019 issue) average 10-year yield is sitting at 2.16%. If you paid attention to SSB yields in the recent months, there seem to be an imminent downward trend, down from a peak of 2.57% in the December 2019 issue.

Furthermore, with the US Federal Reserve making an announcement in earlier this month there will likely be no more interest hikes in 2019, it does look to me that the SSB interest rates will be remaining at current levels of about 2.15% to 2.20%, give or take. For context, DBS Multiplier is able to give me between 2.20% to 2.30% on 50K of funds. The appeal of SSBs is certainly going to pale in the months to come.

What’s actionable for me?

When these pieces of information are assembled, in addition to my anticipation of some big-item purchases within the mid-term horizon, it seems worthy of my time and effort to do review my monthly funds management. Specifically, after discounting for expenses and payments, in between keeping 50K in DBS Multiplier and monthly purchases of SSB, there can be one additional location for me to stash cash - in decreasing liquidity:

- (salary minus expenses and payments)

- (cash) Cash in DBS Multiplier, up to bonus interest cap

- (cash) Additional cash stash

- (SSB) Monthly purchase of SSB

- (investments) Monthly DCA investments via RSPs

Where to stash cash?

In this context, I figured the best way to fulfill my need is another high-yield savings account that does not rely on salary, GIRO payments, credit card spending or any of such requirements, as these are generally already taken up by my DBS Multiplier account. Fixed deposits and the like won’t cut it, due to low relative yields and even lower liquidity. With that mind, a quick internet search gave the following shortlist:

And following is a straightforward comparison:

Account Interest rate Description My take for my needs POSB SAYE 2% Save fixed amount every month, no touching for 2 years 2 years is ok, though I prefer more flexibility for the step-up amount. Fixing the amont does not appeal to me. CIMB FastSaver 1% Flat, no conditions no nothing Too low - though “no conditions” seems terrific as a workhorse account post-retirement. Haven’t research on this yet. Citi MaxiGain ~2.2%, depending on 1-month SIBOR 70K to enjoy base interest rate of 70% of 1-month SIBOR (currently at 1.83%);

Step-up bonus of 0.1% per month, up to 1.2%

(70K is also meets the criteria for Citi Priority banking.)Seems right, aligned with my needs. 70K is reasonable for the base rate, high potential rates, step-up amount is flexible unlike SAYE. Citi Priority as a bonus.

Citi MaxiGain Savings Account

It is pretty clear to me what I should go for. A bit more details on the Citi MaxiGain Savings account (quoted from the MaxiGain page FAQ - emphasis my own):

- The Bank shall pay you a base interest rate (“Base Interest Rate”) at 70% of the 1 month Singapore Dollar Singapore Interbank Offer Rate (“1 month SIBOR”) on your daily balance, up to the first S$150,000 in your MaxiGain account. For example, if 1 month SIBOR is 1.43% p.a., the Base Interest Rate shall be 1% p.a.

- You need to maintain a daily end of day balance of at least $70,000 in your MaxiGain account to earn (the base) interest. Interest at the Base Interest Rate will accrue daily, if you maintain at least S$70,000 in your MaxiGain account, based on the daily end of day balance and will be paid on the last day of the month.

- Your balances capped at S$150,000 shall accrue bonus interest at a rate (“Bonus Interest Rate”) that steps up each month, from 0.10% p.a. to a maximum of 1.20% p.a., if the lowest balance in your MaxiGain account in a month is equal to or greater than the lowest balance in the previous month.

- The Counter increases by 1 each time the Bonus Interest Rate steps up. The Bonus Interest Rate steps up in a month if the lowest balance in that month is equal to or greater than the lowest balance in the preceding month. Bonus interest is computed based on the preceding month’s lowest balance and number of calendar days in the preceding month. The lowest amount of funds in your MaxiGain account at any point in time in a month shall be the “lowest balance” of that month.

Seems to me it is easy to manage the monthly account balance to ensure that the Counter increases by 1 every month, up to 12 times. Certainly easier than the SAYE account which is less flexible.

With that, the final picture should look like this - again in decreasing liquidity:

- (salary minus expenses and payments)

- (cash) Cash in DBS Multiplier, up to bonus interest cap

- (cash) Monthly deposit into Citi MaxiGains

- (SSB) Monthly purchase of SSB

- (investments) Monthly DCA investments via RSPs

Time to get off the laptop and drop by a Citibank branch!