As Covid-19 continues to wreck havoc in many countries around the world, including the US, massive sell-offs have taken place in Wall Street and other markets.

In a move to protect the US economy from the effects of the pandemic, the US Federal Reserve has cut interest rates twice during March 2020 - first in early March, cutting rates by 50 basis points to a targeted range of 1% to 1.25%, then another cut in mid March to a targeted range of 0% to 0.25%. At the same time, a quantitative easing (QE) programme was also launched, entailing US$700 billion worth of asset purchases comprising US Treasury bonds and mortgage-backed securities, i.e. the Fed buys these securities from the market, and basically inject liquidity back into the market.

The last time the Fed has taken steps similiar to this, was during the 08 Global Financial Crisis.

Impact on Singapore and ordinary Singaporeans

Inevitably, interest rates in Singapore (SIBOR, SOR) have always been closely tied to US Fed rates, and hence these rates have been falling as well. For retail investors and lay Singaporeans like myself, there are several effects.

- Falling mortgage rates - housing loans will be cheaper, and refinancing may be viable if it’s an option for you.

- Or, you can even go on leverage

- Local banks and the STI suffer - our favorite DBS, OCBC, and UOB will have their Net Interest Margin (NIM) decrease, affecting their earnings. And with ~35% of the STI is made up of these banks (at time of writing), the STI will drop as well. Of course the banks are not the only reason why the STI suffers.

- Deposit account rates fall - likewise, our favorite DBS Multiplier, OCBC 360, UOB One, and the likes will see a cut in interest rates.

- Singapore Government Securities rates fall - additionally, SGS bonds and SSBs will also see a decrease in yield.

My three main cash stashes: UOB One, Singapore Savings Bond, and CIMB FastSaver

UOB One

UOB One has been my workhorse account for salary crediting, GIRO, credit card spend etc for several months now. The effective rate of the UOB One for 75K used to be 2.436%, if you meet the bonus interest requirements. Effective 1st May 2020, here is what it looks like:

Bonus interest structure for the UOB One account, effective 1st May 2020.

Bonus interest structure for the UOB One account, effective 1st May 2020.

The effective interest rates is now 1.796% for 75K. On the upside, UOB has retained the existing qualifying criteria so that there are no disruptions to our savings routine. Other deposit accounts have also cut their interest rates accordingly.

Singapore Savings Bond

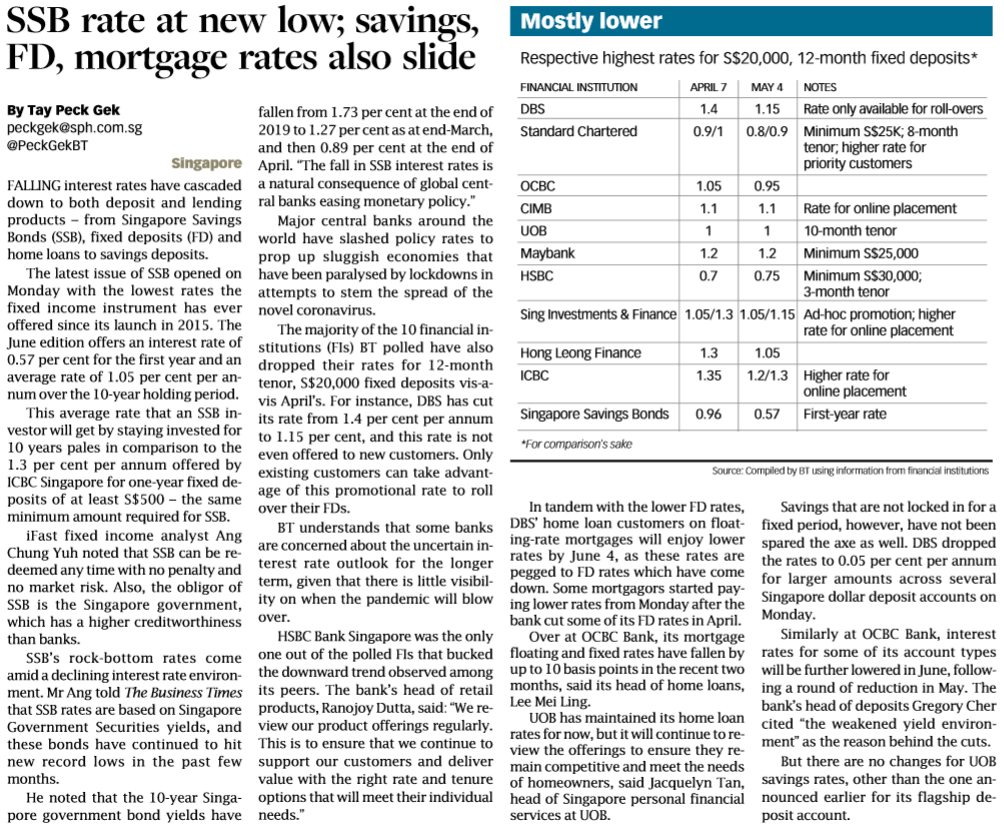

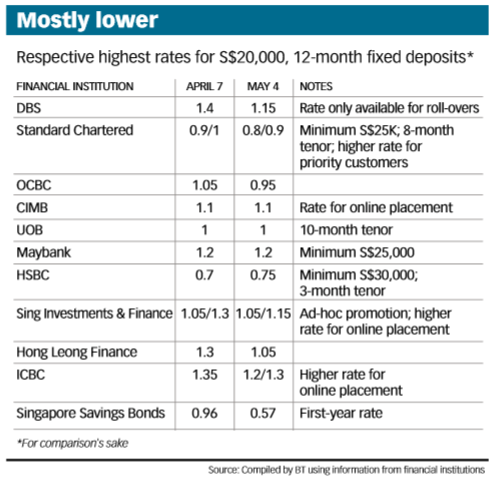

Article from The Business Times 5th May 2020.

Article from The Business Times 5th May 2020.

SSB rates have fallen significantly over the past months, since early 2019. The June 2020 issue of SSB has a first year yield of 0.57% (10-year yield average of 1.05%) - the lowest it has ever been since the launch of SSBs in 2015.

SSB first year and 10-year yields. Source.

SSB first year and 10-year yields. Source.

Of course, SSBs are issued and guaranteed by the Singapore government. Nonetheless, the current state of SSBs, with a first year yield of 0.57% and 10-year average of 1.05%, is a shadow of its former self.

CIMB FastSaver - the hidden star

CIMB FastSaver is my third cash stash. Unlike the typical high-interest workhorse accounts like DBS Multiplier or OCBC 360, the CIMB FastSaver does not have any special requirements of salary crediting, credit card spend, bill payments etc in order to be granted an interest rate of 1% (for first 50K). Considering there is no special requirements, 1% is definitely on the high side, especially in comparison to SSB and current FD rates:

Compare that with the CIMB FastSaver interest rates, as a deposit account:

CIMB FastSaver interest structure.

CIMB FastSaver interest structure.

As of the time of writing this, there doesn’t seem to be any indications from CIMB to adjust the interest rate of the FastSaver account. I sure hope I didn’t jinxed it and it stays this way! Instead of buying any more SSBs, I will place spilled over cash from my UOB One into CIMB FastSaver for now - but I guess I won’t be surprised if there is going to be an adjustment to the CIMB FastSaver rates, putting out the light from the hidden star.